Market Update — November 2025

We firmly believe timely and relevant data is key to making good decisions. To this end, we are committed to providing our community and clients with actionable data and insights about the local real estate market.

Local real estate market

With the data from October 2025 in, here’s an overview of the key aspects of the local real estate market. The real estate data below is collected from Northwest Multiple Listing Service (NWMLS).

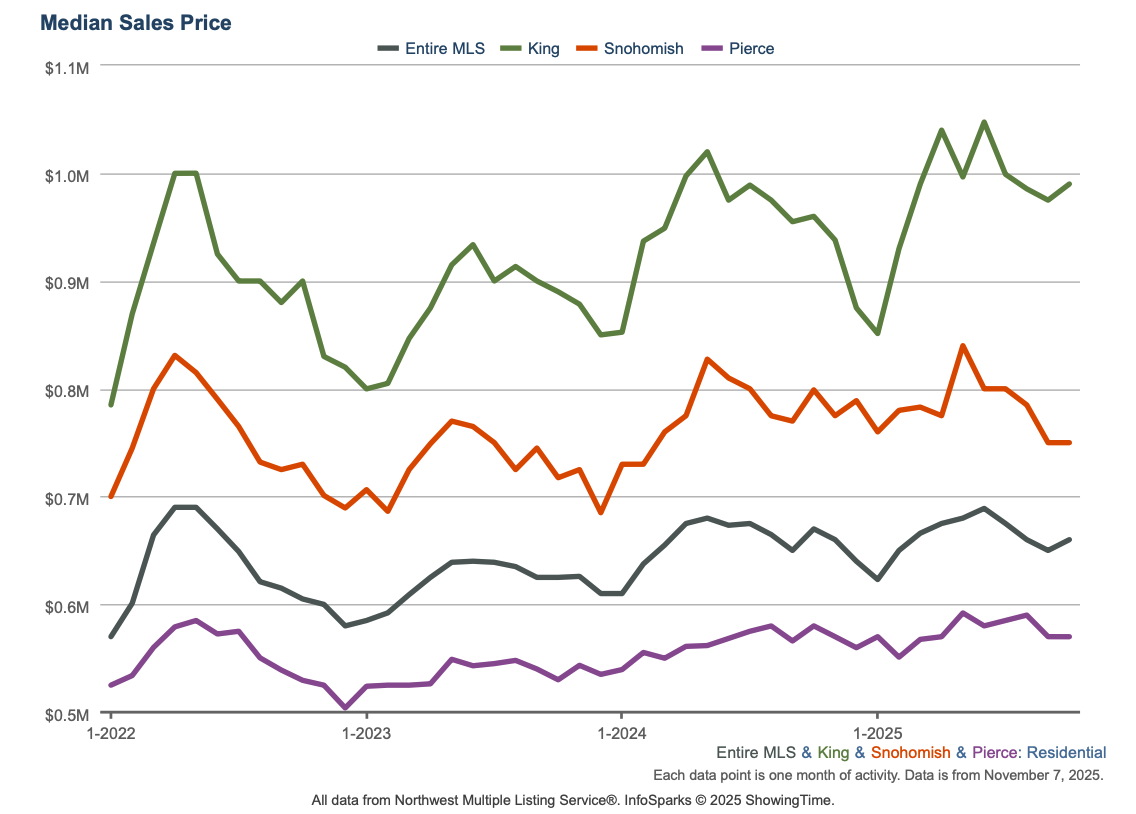

Median price: The chart below shows the latest median sales prices of homes over the past 5 years in the Greater Seattle area over the past five years:

Homes sold: 6,222 homes were sold in October 2025 decreasing by 4% YOY. The median price of $640,000 which represents a slight decrease of 1.5% YOY. This total sale volume translates to a dollar value of about $5.1B.

New construction: 710 new construction homes were sold in October 2025. The median sale price of new construction homes was $757,475.

Months of inventory: Given the current quantity of supply, it’ll take 3.02 months for every listed home to sell. To put this number in perspective, note that the months of inventory for a balanced market is considered to be 4 to 6 months. The counties with the lowest months of inventory in August 2025 were Kitsap (2.06), Snohomish (2.39), Douglas (2.53), Thurston (2.59), Clallam (2.6), and King (2.67). This data point indicates the persistent shortage of supply relative to demand in the area.

New listings: 7,991 new listings were added to the NWMLS database in October 2025 representing an decreasing of 3.4% YOY.

Mortgage rates: The Freddie Mac rate shows no significant monthly change.

Primary Mortgage Market Survey — Average 30-Year Fixed Mortgage Rates over the past 5 years (Source: Freddie Mac)

Broader U.S. economy

Home Builder Confidence Reaches Highest Level Since April: Home builder sentiment rose 5 points to 37 in October, according to the National Association of Home Builders (NAHB) – its highest level since April. Although the index remains below the key 50 mark that signals growth, this uptick marks a nice improvement after confidence hovered between 32 and 34 since May. All three index components saw gains: buyer traffic and current sales each rose 4 points, to 25 and 38, respectively. Most notably, expectations for future sales climbed above 50 into expansion territory for the first time since January.